Real Estate Financial Management Company Explains Deductible Real Estate Taxes

As a property owner or real estate investor in the Nashville, Brentwood, or Franklin area, it’s important to understand what tax deductions are available to you. Real estate taxes are one such deduction, and they can provide you with a valuable tax break. In this blog post, our real estate financial management company will take a closer look at deductible real estate taxes and how they can help reduce your taxable income. So, if you’re looking for ways to lower your tax bill, read on!

What Are Real Estate Taxes?

In the U.S., state and local governments collect taxes on real property, which are also called real estate taxes. Real property generally includes condos, apartments, or other rental property. The tax is generally based on the value of the property, as determined by an assessor.

Real estate taxes are often paid as part of the property owner’s mortgage payments, with the lender forwarding the taxes to the appropriate government agency. The amount of tax owed can vary greatly depending on the location and value of the property. In some cases, the tax may be a significant portion of the overall cost of owning a home. As such, it is important for potential buyers to be aware of the real estate taxes that may be owed on a property before making a purchase.

Real estate taxes are an important source of revenue for many state and local governments. They’re typically used to fund public services such as education, infrastructure, and public safety. Real estate taxes help to ensure that all property owners in the area contribute to the cost of providing these services.

What Real Estate Taxes Are Deductible in Tennessee?

Real estate taxes are typically deductible in Tennessee as long as they meet certain criteria determined by the IRS. This includes what rate the tax is charged at and what the money is used for.

According to IRS Publication 530: “You can deduct the [real estate] tax if it is assessed uniformly at a like rate on all real property throughout the community. The proceeds must be for general community or governmental purposes and not be a payment for a special privilege granted or special service rendered to you.”

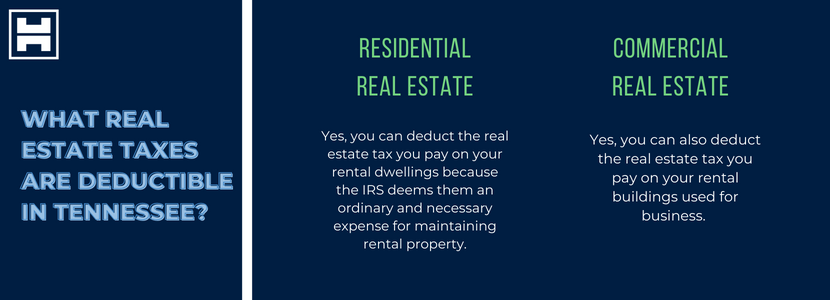

So, does this apply to both residential real estate and commercial real estate?

Residential Real Estate

Yes, you can deduct the real estate tax you pay on your rental dwellings because the IRS deems them an ordinary and necessary expense for maintaining rental property. Keep in mind that you may be limited to $10,000 ($5,000 if married filing separately) per year in real estate tax deductions.

Commercial Real Estate

Yes, you can also deduct the real estate tax you pay on your rental buildings used for business. This is because, similar to residential real estate, the IRS deems property taxes a necessary expense in maintaining a property rented or leased for commercial purposes.

When Are Real Estate Taxes Not Deductible in Tennessee?

In Tennessee, there are a couple of situations in which real estate tax is not deductible. One is delinquent taxes missed by the previous owner if you agreed to pay them when you purchased the building. This would only apply to the year in which you purchased the building in question.

The second situation in which you cannot deduct real estate tax is if some or all of your real estate tax was refunded or rebated to you.

If either of these situations arise, you will not be able to deduct the amount you pay in real estate tax from your taxes that year. However, there are a few ways to offset the cost. For example, if you paid delinquent taxes on the property, you may be able to claim a homestead exemption for that year.

Or, if you paid refunded or rebated real estate taxes, you may be able to deduct them as property taxes on your federal income tax return. Talk to a real estate financial management company or real estate CPA to see if you qualify for any deductions or exemptions.

How to Deduct Real Estate Tax

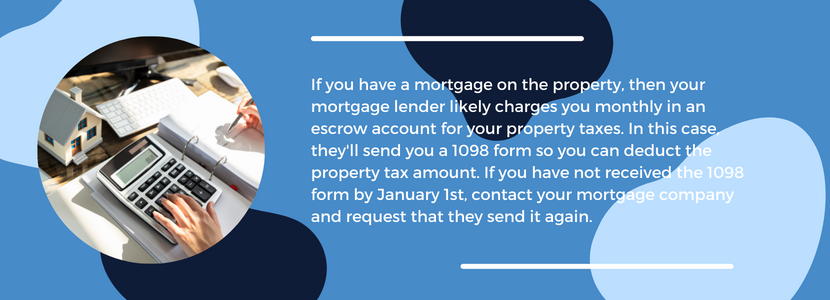

If you have a mortgage on the property, then your mortgage lender likely charges you monthly in an escrow account for your property taxes. In this case, they’ll send you a 1098 form so you can deduct the property tax amount. If you have not received the 1098 form by January 1st, contact your mortgage company and request that they send it again.

If you purchased or sold a home during the tax year, the property taxes may be divided between you and the other party based on how many months each of you owned/will own the house out of that calendar year. In that case, the Department of Housing and Urban Development will send you a Settlement Statement disclosing the amount of property taxes paid by both parties.

Need a Real Estate Financial Management Company to Help You Save on Your Real Estate Taxes?

While all real estate taxes may not be deductible, there are many deductions that property owners in Nashville, Brentwood, Franklin, or the surrounding areas can take advantage of. If you would like help ensuring you get all the tax deductions you should, a real estate financial management company can assist you.

Our team has extensive knowledge in real estate investing and we would be happy to help you maximize your tax return and manage your real estate accounting. Have questions? Contact us for more information or to schedule a consultation. We look forward to hearing from you!

Recent Comments